|

|

|

|

On behalf of the Board of Directors, I am pleased to present

the Annual Report of Melewar Industrial Group Berhad and its

group of companies ("the Group") for the financial year ended

30 June 2025 ("FY2025").

On behalf of the Board of Directors, I am pleased to present

the Annual Report of Melewar Industrial Group Berhad and its

group of companies ("the Group") for the financial year ended

30 June 2025 ("FY2025").

OUR BUSINESS AND OPERATIONS

The Group's core operations remain anchored in the steel

industry, primarily through its 74.13% stake in the listed

subsidiary, Mycron Steel Berhad ("Mycron"), which is engaged

in the manufacturing of Cold Rolled Coil ("CRC") steel sheets

and Steel Tubes and Pipes ("Steel Tube").

In addition to steel, the Group also manages other businesses

through its two wholly-owned subsidiaries:

- Ausgard Quick Assembly Systems Sdn Bhd ("AQAS"),

which develops commercial and residential structures for

niche property markets using the Industrialised Building

System ("IBS"); and

- Bumi Sdn Bhd ("3Bumi"), which is involved in the trading

and distribution of food products.

FINANCIAL PERFORMANCE

FY2025 proved to be a particularly challenging year, as

the Group contended with a volatile operating landscape

characterised by persistently weak global steel prices, rising

competition from imports, and trade headwinds triggered by

geopolitical tensions. The year was further weighed down by

the imposition of US tariffs and the removal of Malaysian and

Vietnamese steel mills from Mexico's approved exporter list,

which collectively disrupted external trade flows.

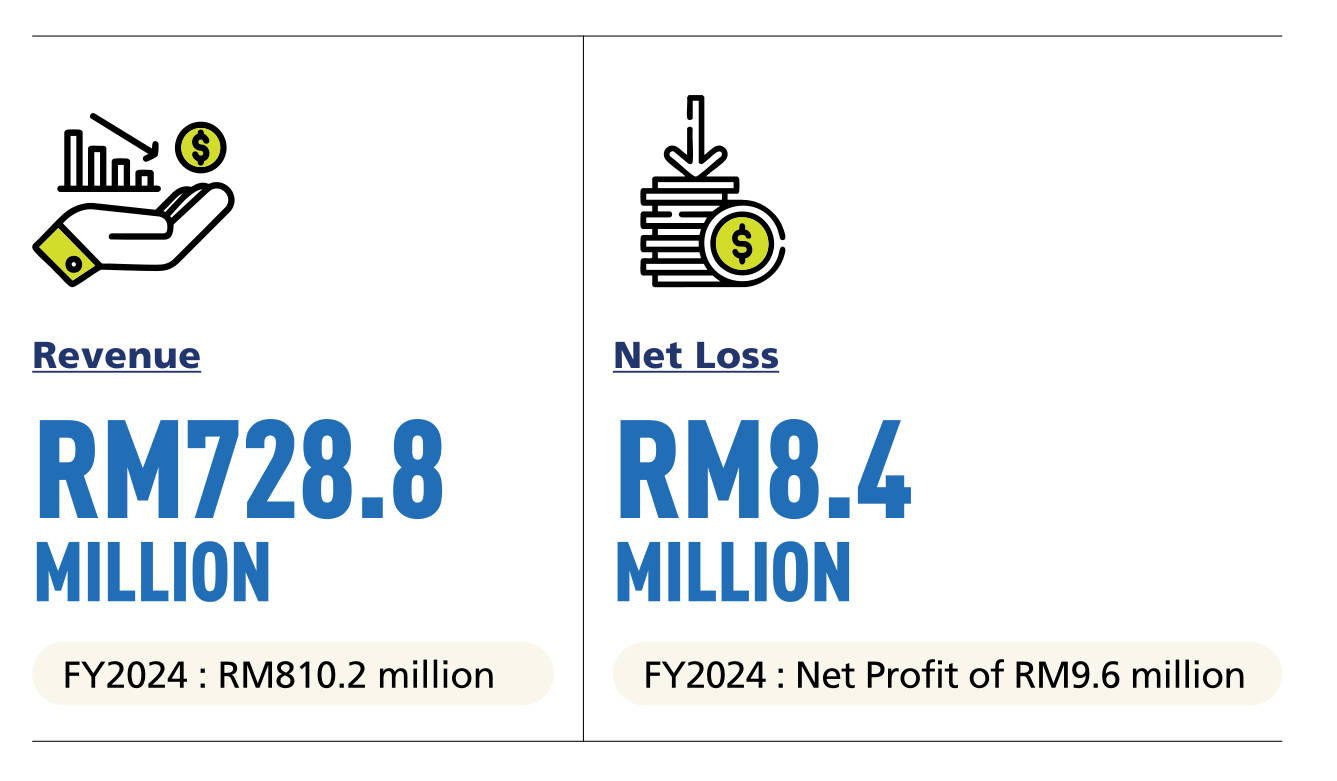

Against this backdrop, the Group's revenue declined by

10% to RM728.8 million, from RM810.2 million in FY2024.

The reduction was mainly attributable to weaker overseas

demand, which drove a 31% contraction in CRC segment

export sales and a 28% decline in the Steel Tube segment. In

addition, average unit selling prices for both CRC and Steel

Tube products fell by 11%, reflecting the sustained downtrend

in global steel prices.

FINANCIAL PERFORMANCE (CONT'D)

As a result, the Group

posted a net loss of

RM8.4 million for

FY2025, compared with

a net profit of RM9.6

million in the preceding

year. This translated into

a loss per share of 2.24

sen, versus earnings

per share of 1.43 sen in

FY2024.

Despite the weaker earnings, the

Group continues to maintain a sound

financial position. As of 30 June 2025,

Group shareholders' equity stood at

RM419.0 million, representing a net

asset value per share of RM1.17. Net

debt was reduced significantly to

RM23.3 million, from RM64.2 million

a year earlier, resulting in a lower

net gearing ratio of 4% (FY2024:

12%), which remains well within the

Group's debt capacity.

|

|

|

|

|

|

|

|

STEEL DIVISION

|

Mycron's steel operations are carried out through three subsidiaries:

- Mycron Steel CRC Sdn Bhd ("MCRC"), which operates in the

midstream segment by converting Hot Rolled Coil ("HRC") into

thinner gauge CRC steel sheets;

- Melewar Steel Tube Sdn Bhd ("MST"), which is in the downstream

segment, manufacturing Steel Tubes from HRC or CRC; and

- Silver Victory Sdn Bhd ("SV"), a smaller unit engaged in trading

steel-related products.

|

STEEL DIVISION (CONT'D)

|

Steel Operation Review

In the first financial quarter of

FY2025, the Steel Division reported

revenue of RM198.4 million and a Loss

Before Tax ("LBT") of RM2.6 million.

Performance was adversely affected

by the steepest and longest steel price

downtrend since the pandemic, with

prices falling below USD490/tonne

in September 2024. Competitive

pressures intensified from both legal

and illegal imports, particularly from

China. Export demand was softer,

HRC-CRC price spreads narrowed, and

a sharp Ringgit appreciation further

eroded margins. Nevertheless, the

division sustained export sales, which

contributed 20% of total revenue for

the quarter.

In the second financial quarter,

revenue rose 3% quarter-on-quarter

to RM204.1 million, supported by

stronger sales volumes in the CRC

segment (up 13% mainly from

exports) and the Steel Tube segment

(up 6%). However, the positive

volume effect was tempered by lower

average selling prices, in line with

the ongoing steel price downtrend.

The division also benefited from a

net foreign exchange gain of RM1.3

million, compared with a net loss

of RM2.9 million in the preceding

quarter, as the Ringgit depreciated

against both the USD and SGD after

its sharp appreciation in Quarter 1.

Consequently, the division returned

to profitability with a Profit Before

Tax ("PBT") of RM1.9 million.

In the third financial quarter, revenue

fell sharply by 26% to RM151.6

million, driven by lower sales volumes

in both CRC segment (down 28% due

to weaker exports) and the Steel Tube

segment (down 22% due to heavier

Chinese pipe imports). Seasonal

factors, including fewer working

days during the Chinese New Year

and Ramadan, further reduced sales.

Although steel prices stabilised during

the quarter, external conditions

worsened: the US proposed heavy

levies on Chinese-owned or flagged

vessels (on 21 February 2025), a 25%

tariff was imposed on all imports

from Mexico and Canada (effective

4 March 2025) and the US extended

a blanket 25% tariff on all steel and

aluminium imports under Section

232 of the Trade Expansion Act

1962, removing all prior exemptions

(effective 12 March 2025). These

measures disrupted regional supply

chains and severely curtailed the Steel

Division's export orders, margins,

and deliveries to the US and related

markets.

In the fourth financial quarter,

the Steel Division's performance

rebounded, with revenue rising

11% quarter-on-quarter to RM167.8

million. CRC segment sales volumes

grew 11%, while Steel Tube segment

volumes surged 39%, partly reflecting

recovery from the shorter working

period in Quarter 3. However, margins

remained under pressure as diverted

Chinese steel exports flooded the

region, compounding the impact

of US tariffs. Gross profit fell 29%,

further weighed down by a RM0.7

million impairment on property,

plant, and equipment.

|

|

FOOD DIVISION

|

The Food Division, managed under 3Bumi, continues to represent a relatively

small share of the Group's overall business portfolio.

The Food Division, managed under 3Bumi, continues to represent a relatively

small share of the Group's overall business portfolio.

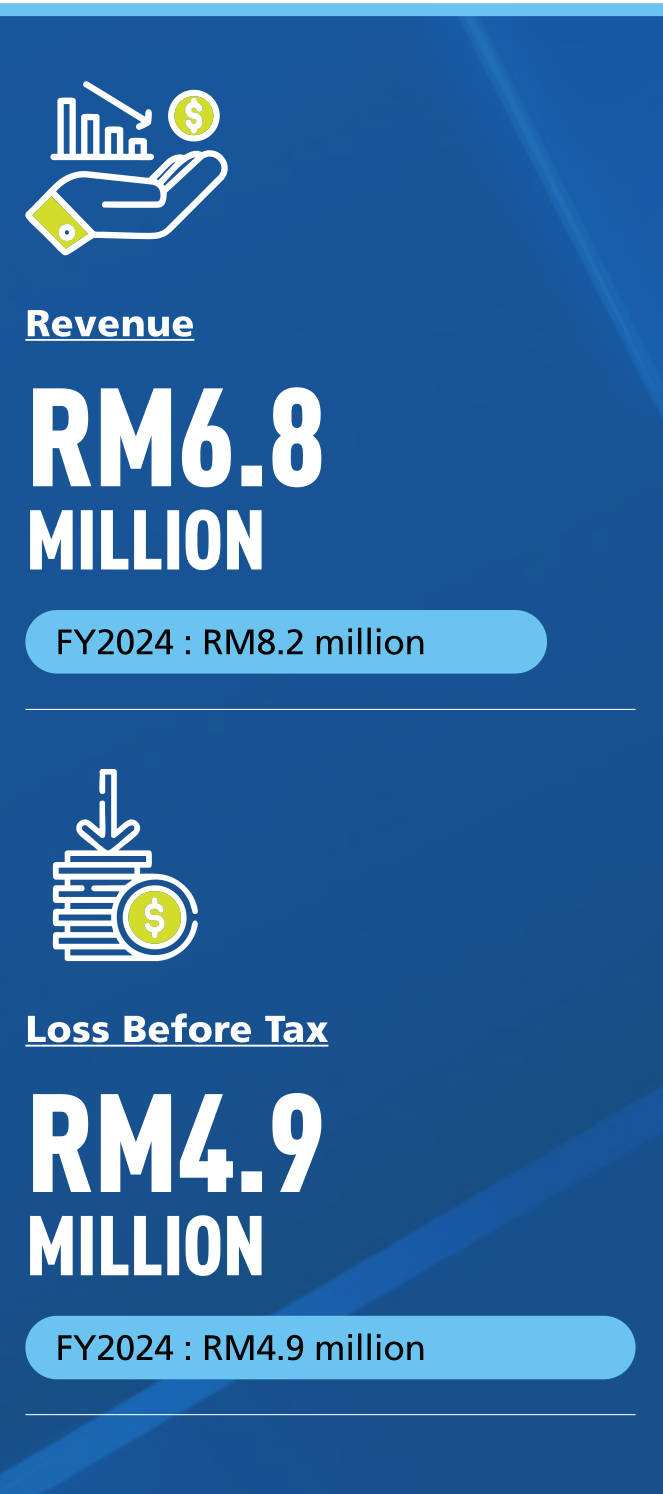

In FY2025, performance remained underwhelming, largely reflecting subdued

consumer sentiment. Rising food price inflation and affordability concerns

dampened household spending, including during festive periods when demand

would typically strengthen. Domestic sales were weaker than expected, and

overall market conditions remained lacklustre.

As a result, divisional revenue declined by 17% year-on-year to RM6.8 million.

The division maintained a stable LBT of RM4.9 million, broadly unchanged

from the previous year.

|

|

COMMITMENT TO GOOD CORPORATE GOVERNANCE

|

The Board has continued to exercise clear oversight and provide strategic

guidance in navigating an increasingly complex regulatory and risk landscape.

The Group remains committed to upholding strong governance practices,

with the Board actively engaging management on matters of strategy,

risk management, and stakeholder expectations. The Board firmly believes

that sound governance is essential to sustaining the Company's long-term

performance and its ability to deliver consistent value to shareholders.

The Board has continued to exercise clear oversight and provide strategic

guidance in navigating an increasingly complex regulatory and risk landscape.

The Group remains committed to upholding strong governance practices,

with the Board actively engaging management on matters of strategy,

risk management, and stakeholder expectations. The Board firmly believes

that sound governance is essential to sustaining the Company's long-term

performance and its ability to deliver consistent value to shareholders.

SUSTAINABILITY INTEGRATION & DIRECTION

In FY2025, the Group made notable progress in

advancing its environmental and social agenda, with ESG

(Environmental, Social, and Governance) considerations

increasingly embedded into operations. The adoption of

IFRS S1 and S2 standards has strengthened climate-related

disclosures and integrated risk management into business

decisions-an important step toward building long-term

resilience. Aligning ESG with enterprise risk management

has further enhanced the Group's ability to anticipate and

respond to emerging challenges, including supply chain

disruptions, regulatory developments, and climate-related

risks.

The Group remains mindful of its responsibility to society

and the environment. Ongoing sustainability initiatives

focus on improving the social and economic wellbeing

of local communities, while advancing environmental

commitments such as reducing carbon emissions and water

usage, enhancing waste management, and embedding

sustainable practices across operations. These initiatives

are central to creating long-term value and delivering on

the Group's ESG priorities.

Consistent with the previous year, the Group has

undertaken limited assurance on selected sustainability

information, underscoring its commitment to transparency

and accountability. Further details are set out in the

Sustainability Statement.

|

PROSPECTS FOR THE NEW FINANCIAL YEAR

|

As the Group enters FY2026, the operating landscape is expected to remain challenging and volatile against a backdrop

of persistent global uncertainties. Domestically, the new financial year has already seen cost escalations, including higher

sales and service taxes, port tariffs, electricity tariff adjustments, rising wages and logistics costs. These increases will

substantially impact production and operating expenses, most of which cannot be passed on to customers due to the

pricing inelasticity of steel and food products and the availability of lower-priced import alternatives. This rising cost of

doing business, seen in recent years, continues to erode the competitiveness of Malaysia's steel manufacturers and food

traders.

|

Steel Division Outlook

Global steel dynamics remain pressured. Although China's announced

production cuts may help partially rebalance supply, they are unlikely to fully

offset the short-term oversupply caused by aggressive export activity.

At the same time, stimulus measures in China have yet to deliver meaningful demand recovery. With global demand

subdued and competition intensifying, Malaysia's steel sector continues to face significant import pressure.

On the domestic front, the S&P Global Manufacturing PMI rose to 49.9 in August 2025, the highest since February

2025, though it remained below the neutral 50 mark for the 12th consecutive month, signalling continued

contraction. Encouragingly, the Government has taken measures to cushion external pressures by accelerating

National Plan projects and easing banking reserve requirements to boost liquidity. Recent enforcement actions

against smuggled and mis-declared steel imports have also helped curb unfair trade, while local steel associations

are actively promoting greater localisation of steel usage among foreign-owned businesses. These measures have

supported a gradual recovery in domestic demand, particularly for Cold Rolled Coils.

|

PROSPECTS FOR THE NEW FINANCIAL YEAR (CONT'D)

|

Food Division Outlook

Globally, the meat market (fresh and processed) is expected to record steady

growth in developing economies, though demand in advanced markets may

moderate as consumers shift toward healthier and more sustainable diets.

Geopolitical risks, including armed conflicts and political

instability, continue to drive volatility in staple food

markets, complicating global trading strategies. Price

fluctuations and supply disruptions from key exporters

remain significant challenges for food traders.

In Malaysia, higher business costs are putting additional

pressure on food prices. With wholesale and retail

margins already compressed, statutory cost increases

risk undermining affordability and competitiveness.

Businesses remain cautious about raising prices, given

signs of consumer pullback.

Recognising these headwinds, the Group intends to

reposition the Food Division through a more strategic

approach. Key initiatives under review include:

- Product portfolio realignment - focusing on higher

margin or niche categories with more resilient

demand;

- Cost optimisation - improving operational efficiency

to narrow losses;

- New sales channels - expanding into e-commerce

and forming partnerships with established retailers

to expand market reach; and

- Selective export expansion - leveraging overseas

demand for Malaysian food products.

These initiatives will be critical in determining whether

the Food Division can deliver sustainable growth and

meaningful contributions, or whether its role should be

reshaped within the Group's broader portfolio strategy.

|

|

CONCLUSION

|

In conclusion, the Group acknowledges that FY2026 will remain a demanding year, with rising costs and global headwinds

weighing on performance. Nevertheless, opportunities exist through resilience, efficiency, and strategic adaptation. Key

initiatives-including pursuing anti-dumping measures, expanding into new markets, and strengthening stakeholder

engagement are expected to enhance competitiveness and support the Group's long-term growth trajectory.

|

ACKNOWLEDGEMENTS

On behalf of the Board, I would like to express my profound appreciation

and thanks to all our people across the Group for their dedication, hard work

and contributions throughout FY2025. Their commitment and perseverance

remain central to the Group's continued progress and resilience.

I would also like to convey my sincere thanks to my fellow Board members for their steadfast support, strategic

input and guidance during the past year.

To our valued business partners, customers, suppliers, and shareholders; we deeply appreciate your trust and

unwavering support.

|

|

TUNKU DATO' YAACOB KHYRA

Executive Chairman

|

|

|

|

|

|

|